"Jeff Bezos' Tax-Saving Miami Move and $2 Billion Amazon Stock Sale"

TL;DR Summary

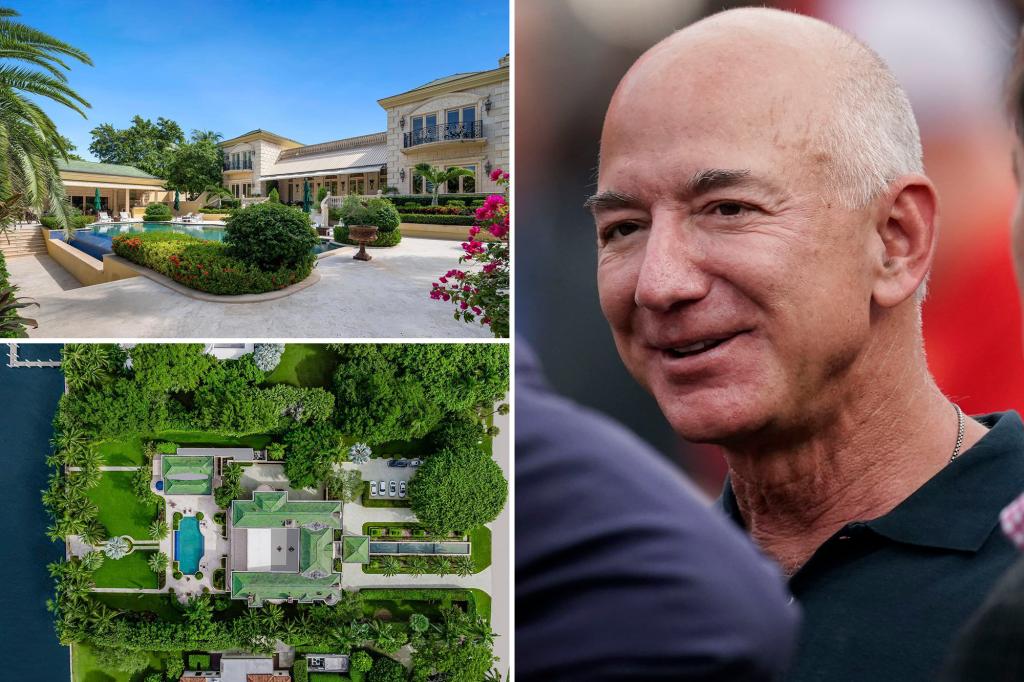

Jeff Bezos is set to save over $600 million in taxes by making Miami his primary residence, allowing him to avoid state income and capital gains taxes. His move from Seattle to Miami comes with significant tax advantages, with the potential to save him $140 million in capital gains taxes on a recent stock sale and an estimated $610 million by 2025. The move to Florida also exempts him from estate taxes, potentially saving him billions in the long run. Bezos has made high-profile real estate purchases in Miami, including a $79 million mansion and a $68 million property, and is expected to build a megamansion on the exclusive island Indian Creek.

- Jeff Bezos will save over $600M in taxes on his stock sale thanks to Seattle-Miami move New York Post

- Jeff Bezos will save over $600 million in taxes by moving to Miami CNBC

- Jeff Bezos' move to Florida saving him hundreds of millions in taxes Fox Business

- Jeff Bezos sells $2 billion of Amazon shares amid stock surge that has him within reach of becoming the world's richest person Fortune

- Bezos Sells $2 Billion of Amazon Shares in First Major Stock Sale Since 2021 Bloomberg

Reading Insights

Total Reads

0

Unique Readers

11

Time Saved

3 min

vs 4 min read

Condensed

85%

744 → 112 words

Want the full story? Read the original article

Read on New York Post